Openbank Onboarding Vision

A service design vision for a clearer, more supportive digital banking onboarding experience.

Project Summary

The discovery and co-design phase focused on exploring how users envision the future of online banking onboarding, working closely with users and stakeholders to define a future onboarding vision for Openbank, the online bank of the Santander Group. The work centred on reducing uncertainty, increasing user confidence, and shaping a more human and supportive onboarding experience within a regulated financial context.

Role: Senior Service Designer (Consultant)

Platform: Mobile app

Focus: Discovery research · Co-design workshops · Future onboarding vision

Context

Digital banking onboarding is often one of the most demanding moments in the customer journey. Users are asked to share sensitive personal information, complete identity checks, and make decisions quickly, often without feeling confident or fully supported.

Openbank was launching as a fully digital bank with no physical branches. That meant onboarding was not just a setup step, it was the entire first impression of the product.

However, across the wider banking group, onboarding flows were widely perceived as long, form-heavy, and difficult to complete. Users often complained about too many questions, unclear steps, and not knowing how long the process would take. Many had to pause mid-way, and when they returned, they felt lost or unsure what to do next.

Openbank wanted to explore what a next-generation onboarding experience could look like: one that felt easier, clearer, and more human, while still meeting banking and compliance requirements.

Goal

The goal of this project was to define a future onboarding vision grounded in real user needs, behaviours, and moments of uncertainty across the end-to-end service.

The focus was on understanding what “good onboarding” should feel like in a fully digital bank, and how to make a complex, regulated process feel clearer, more supportive, and more human.

Challenge

How might we design a future onboarding experience that helps users feel confident and supported, while still meeting banking and compliance requirements?

Role and responsibilities

I was brought in to lead the discovery phase and help Openbank build a user-led service vision for what “good onboarding” should feel like in the future.

I worked across London and Madrid, collaborating with users and cross-functional stakeholders to gather insights, test assumptions, and understand how onboarding worked as a service across markets.

I also helped align stakeholders around a shared definition of “good onboarding”, translating qualitative insights into clear service principles, journey frameworks, and onboarding concepts the UX team could later design and test.

Approach

This project was highly research-driven and focused on understanding onboarding as an end-to-end service rather than a single flow.

My work included:

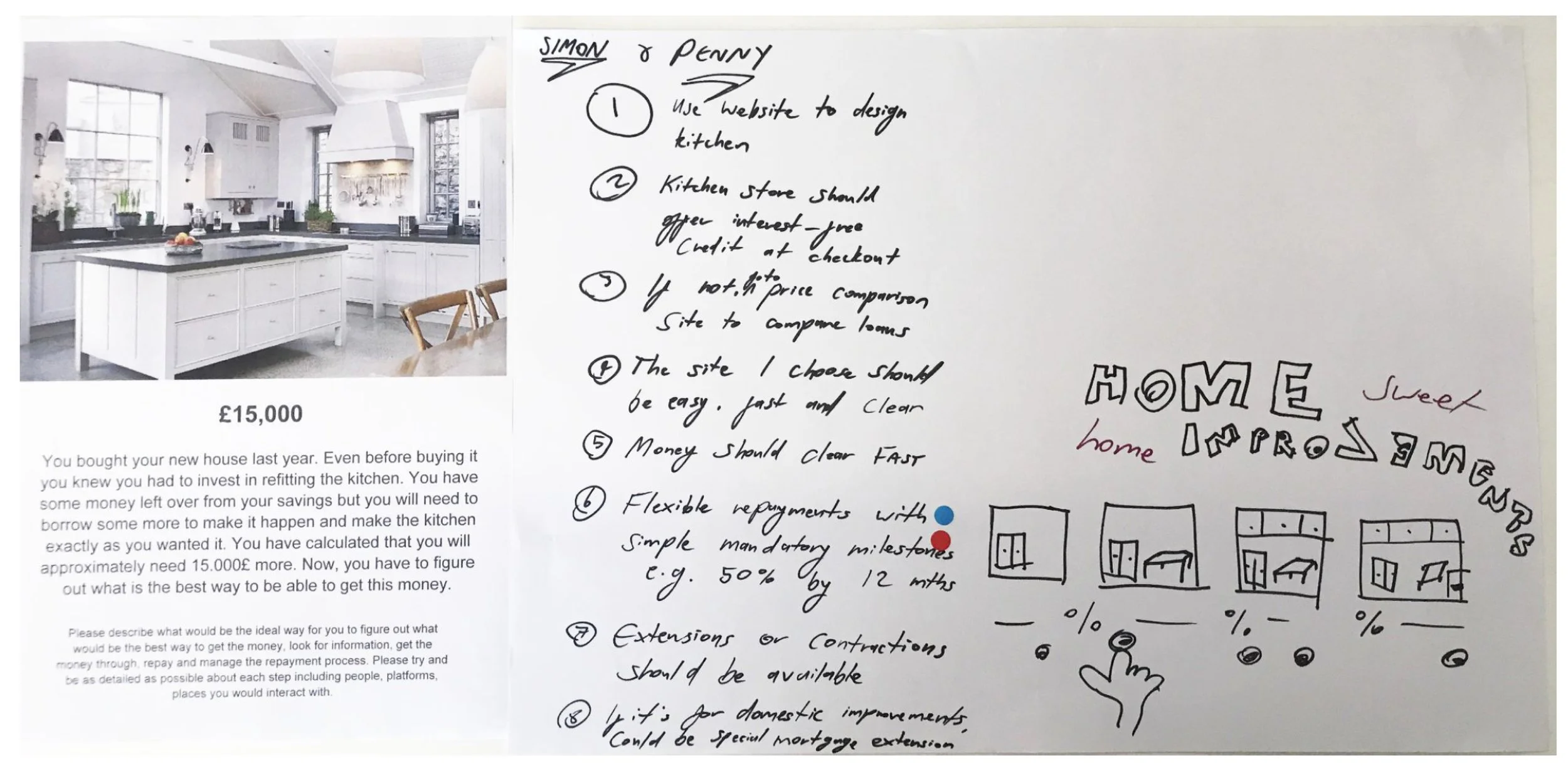

User interviews to understand expectations, anxieties, and decision-making during onboarding

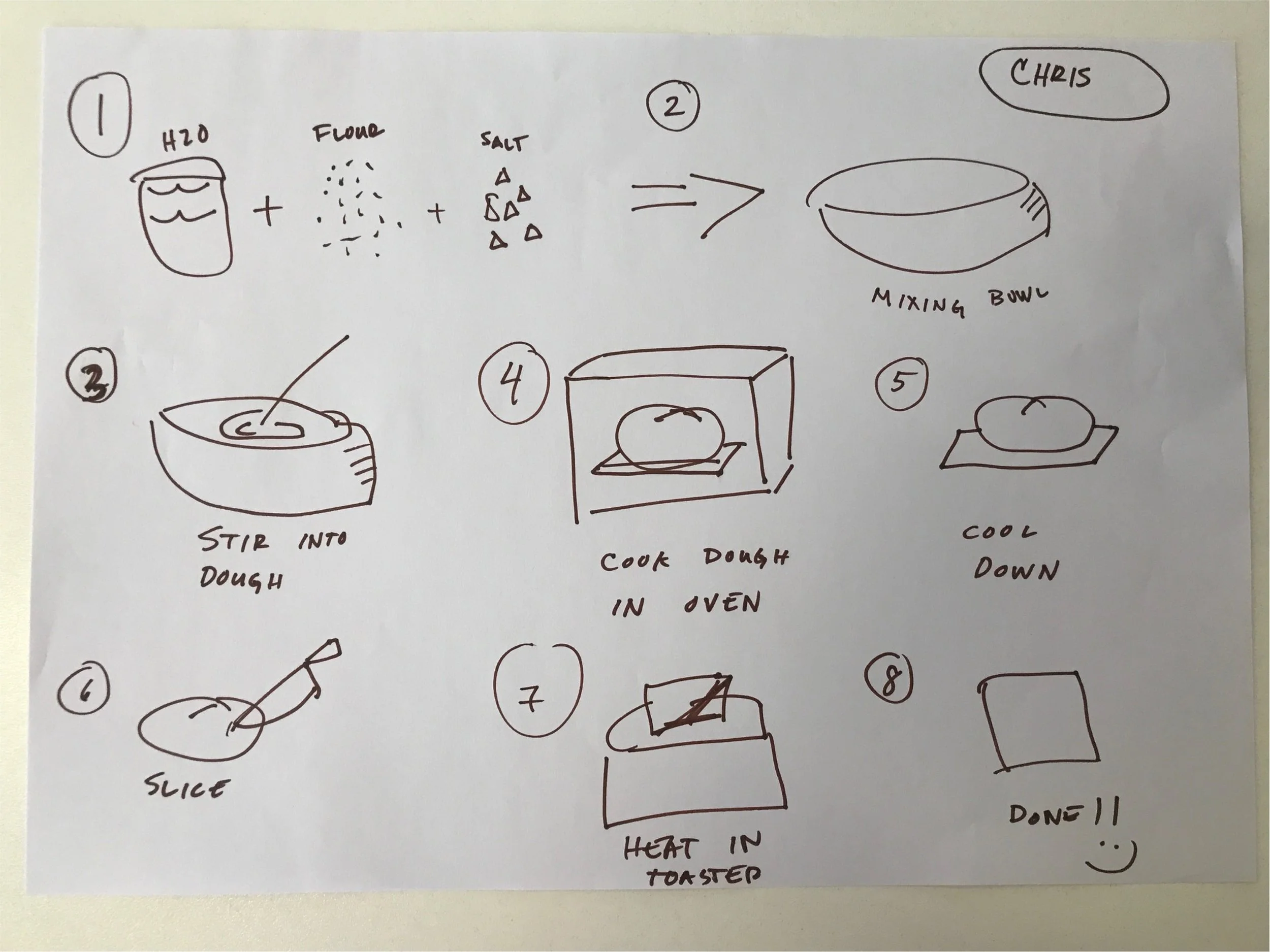

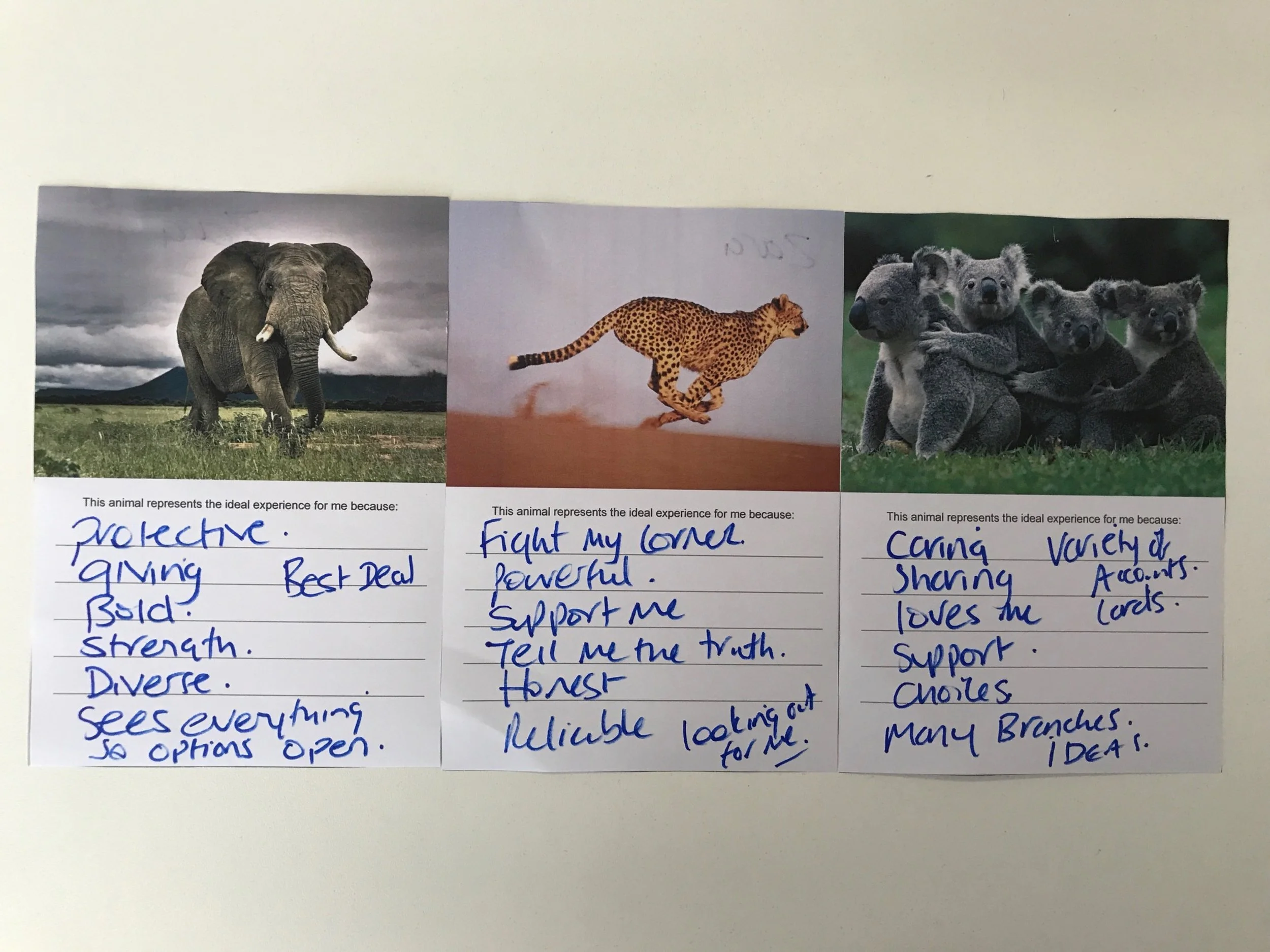

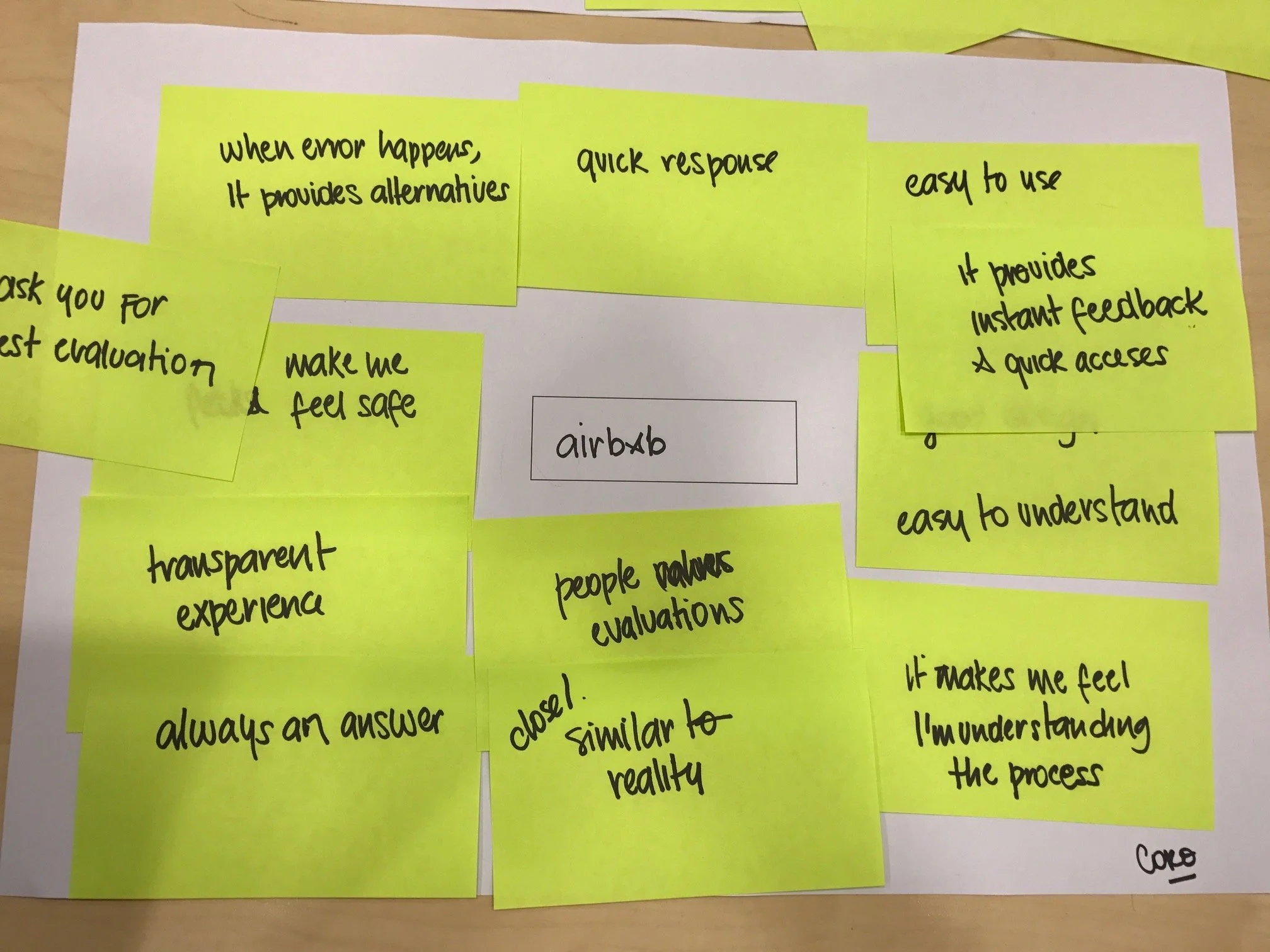

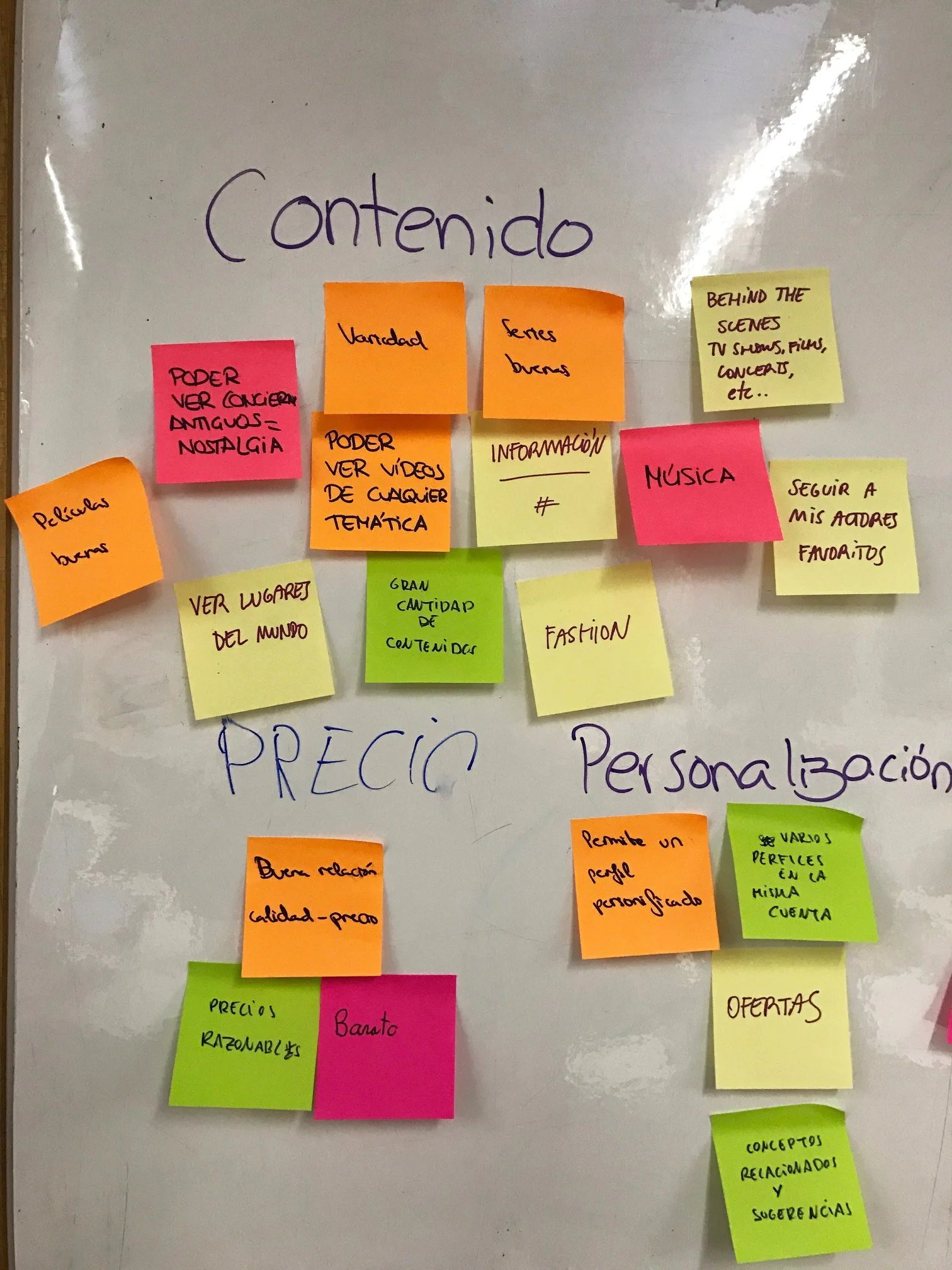

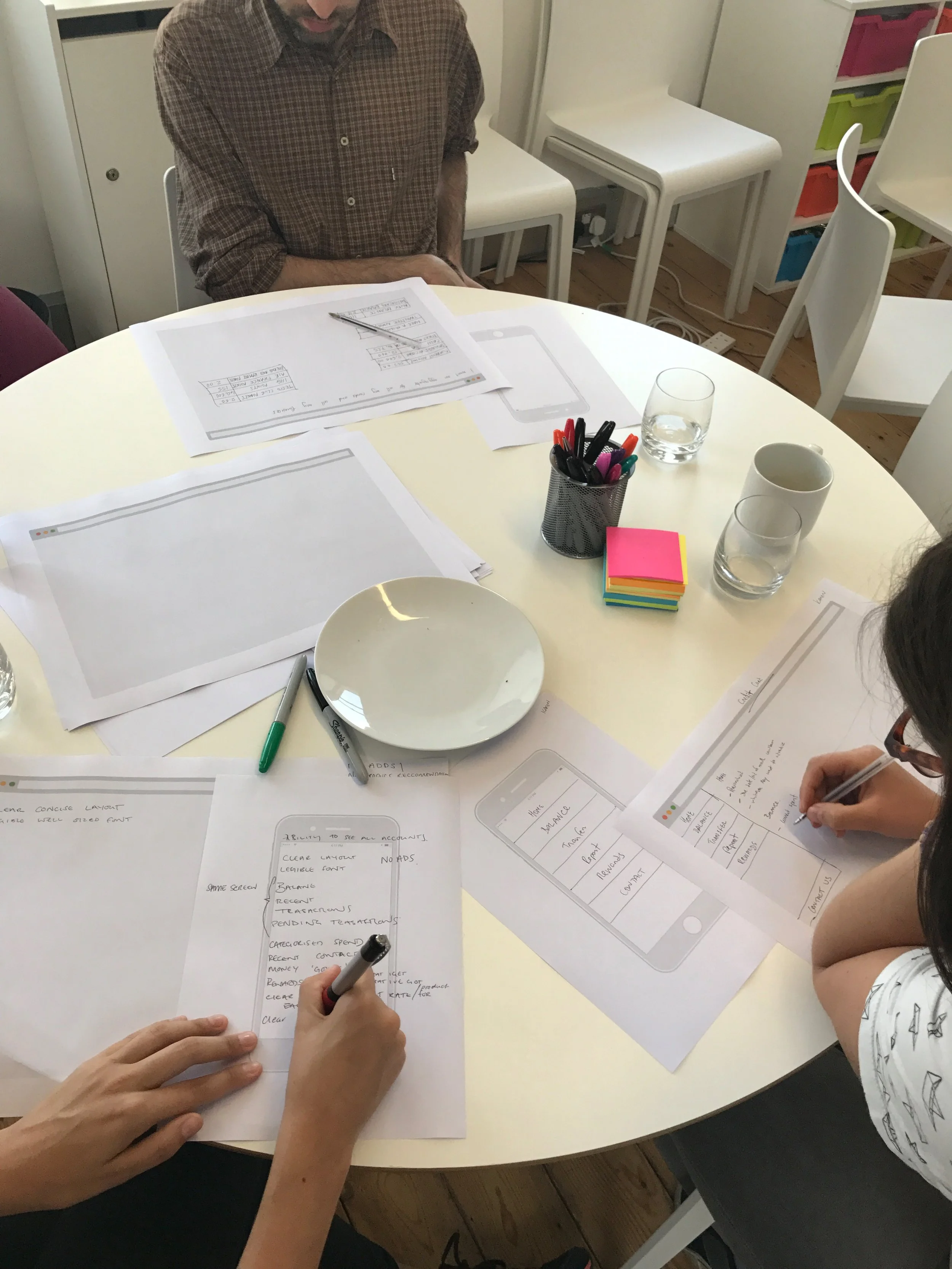

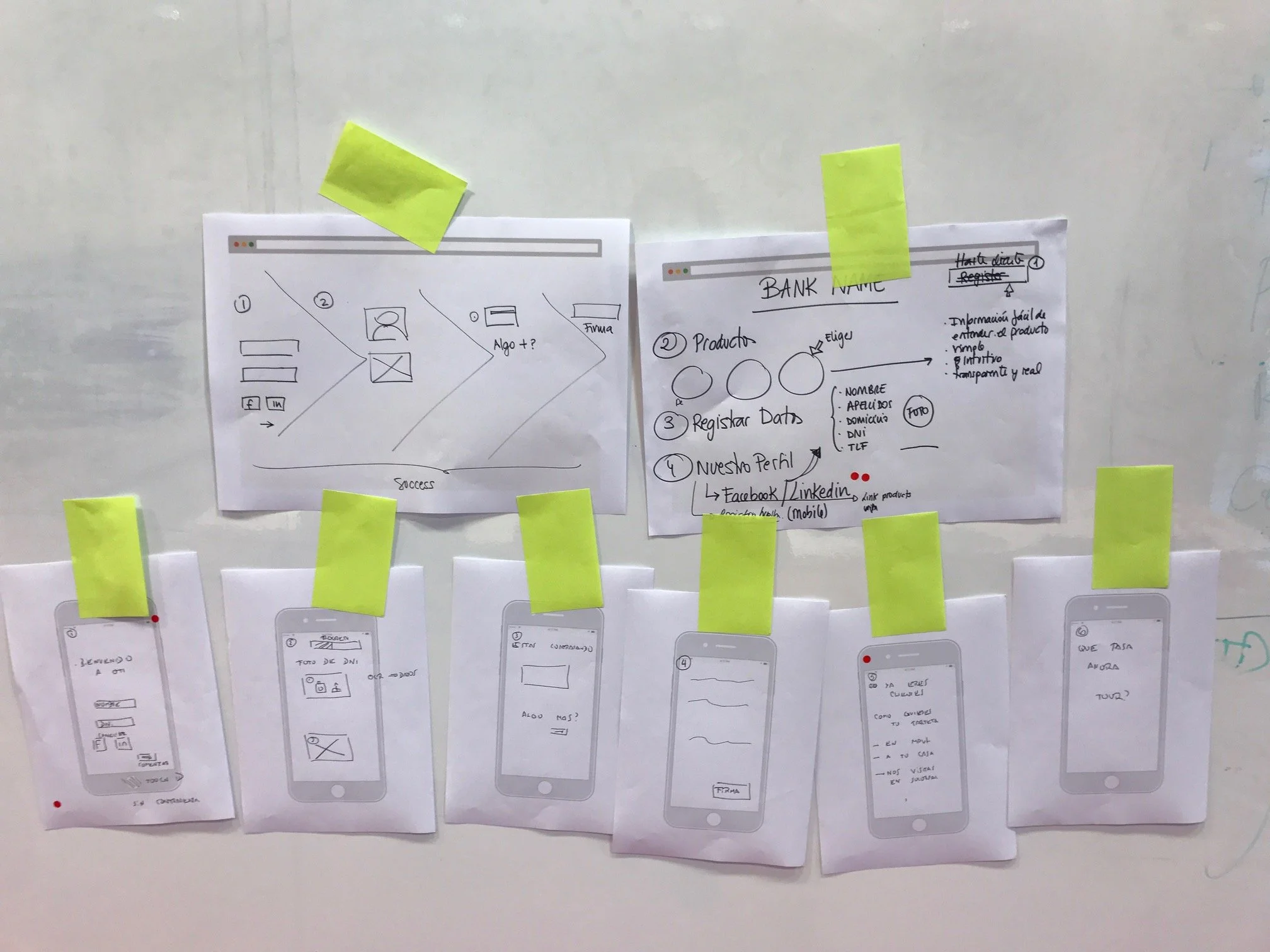

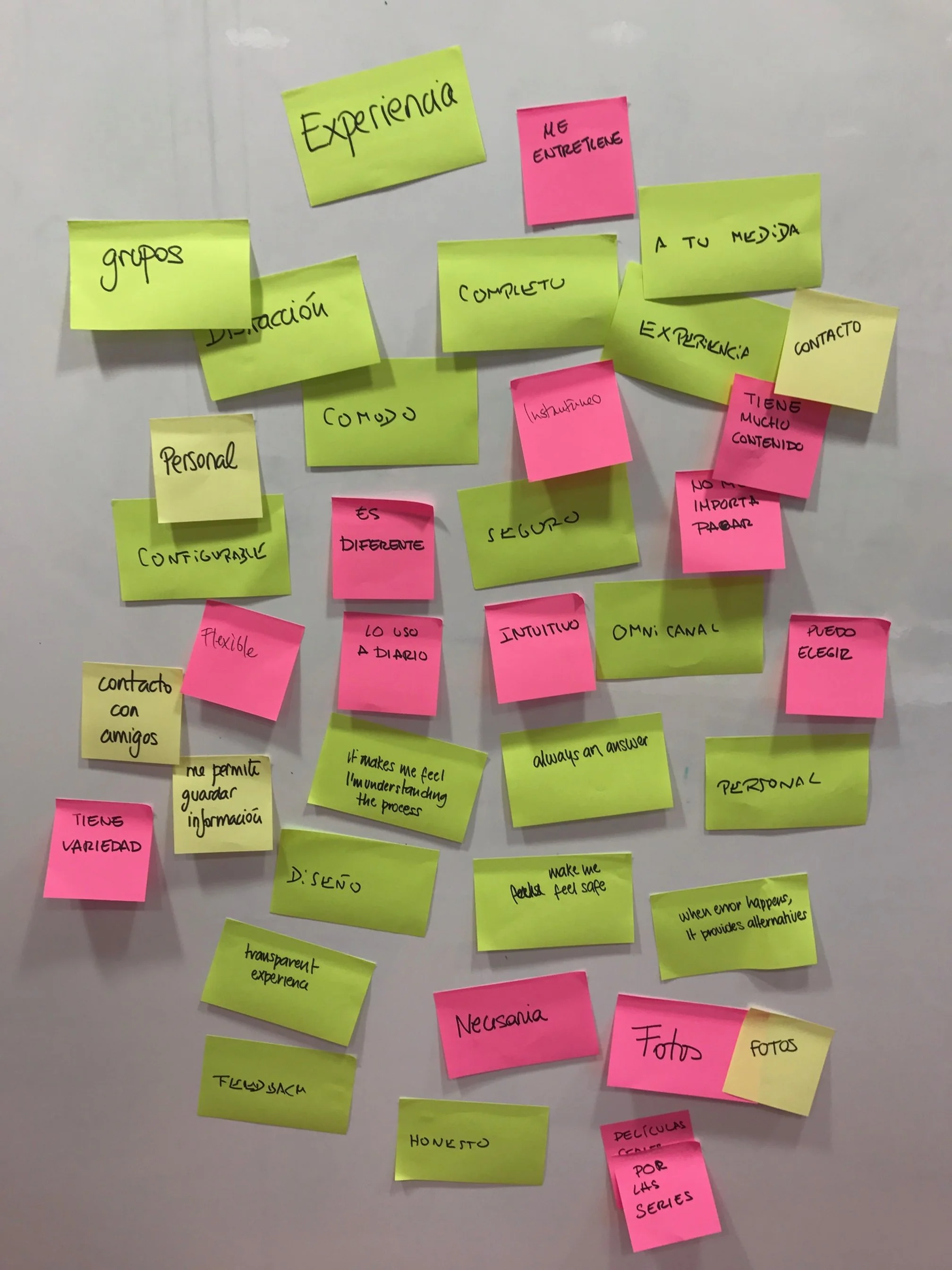

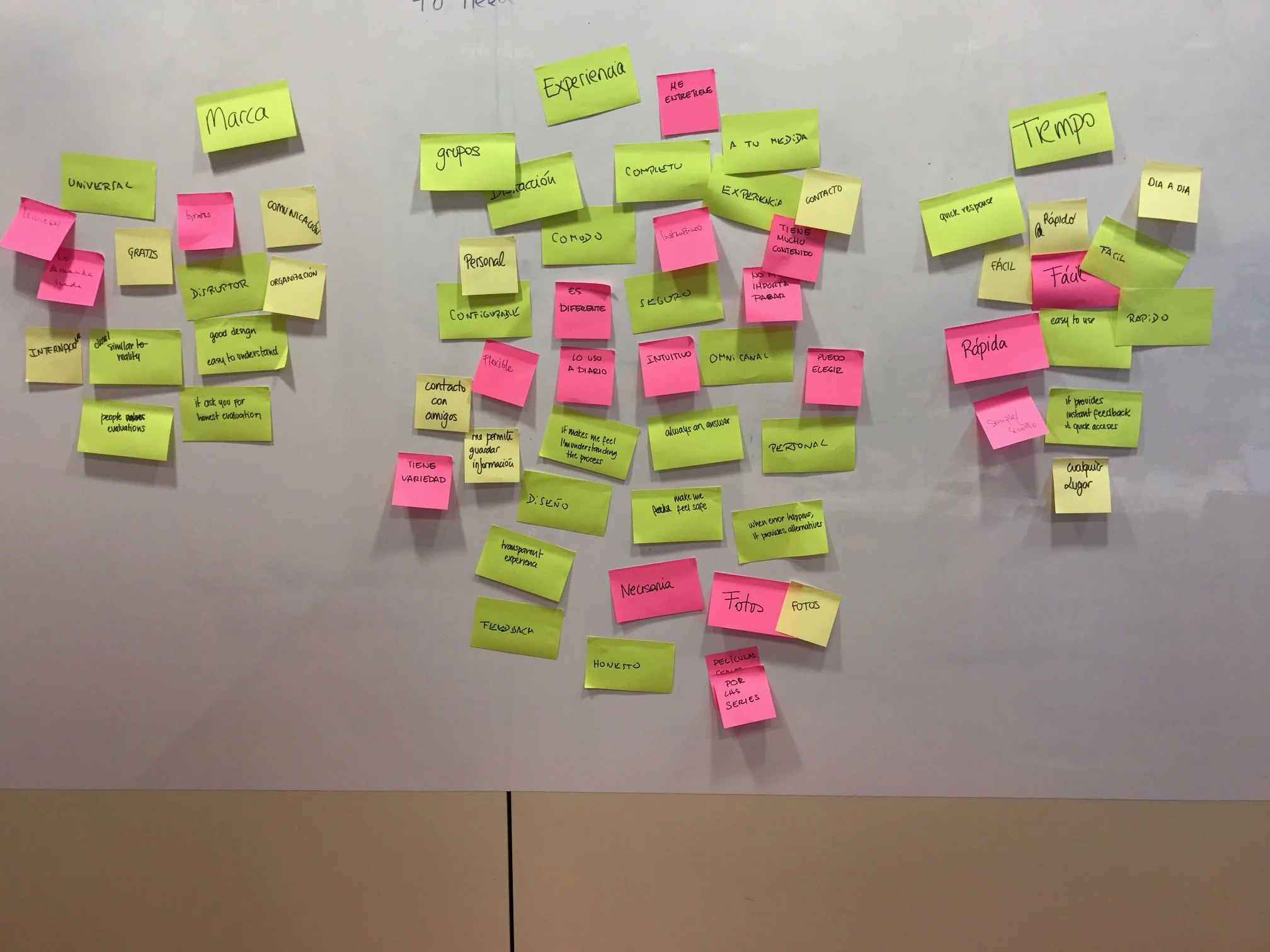

Co-design workshops (3-hour sessions) to explore what clarity, trust and reassurance look like in practice

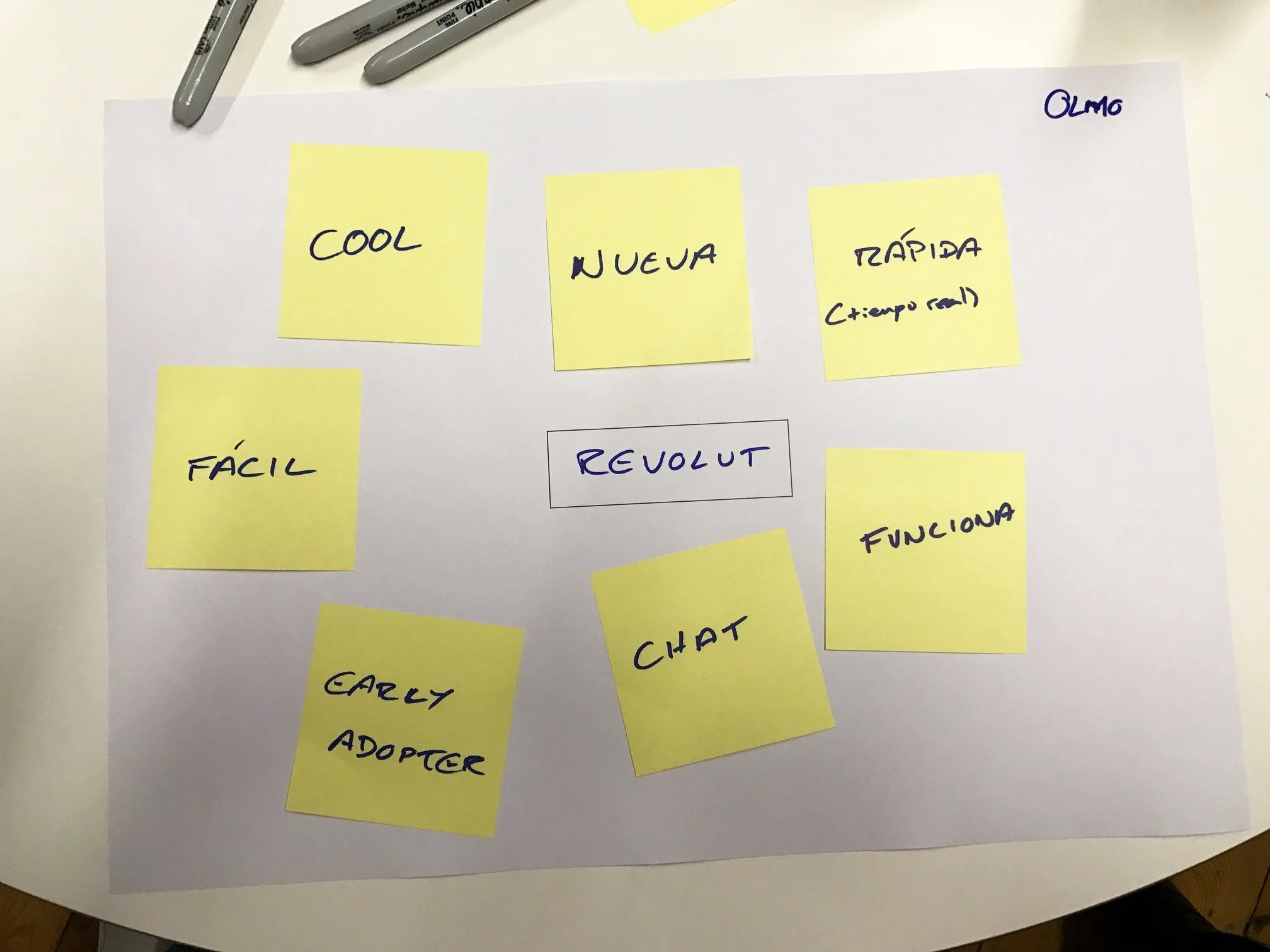

Benchmarking and competitive analysis across digital banking and adjacent industries

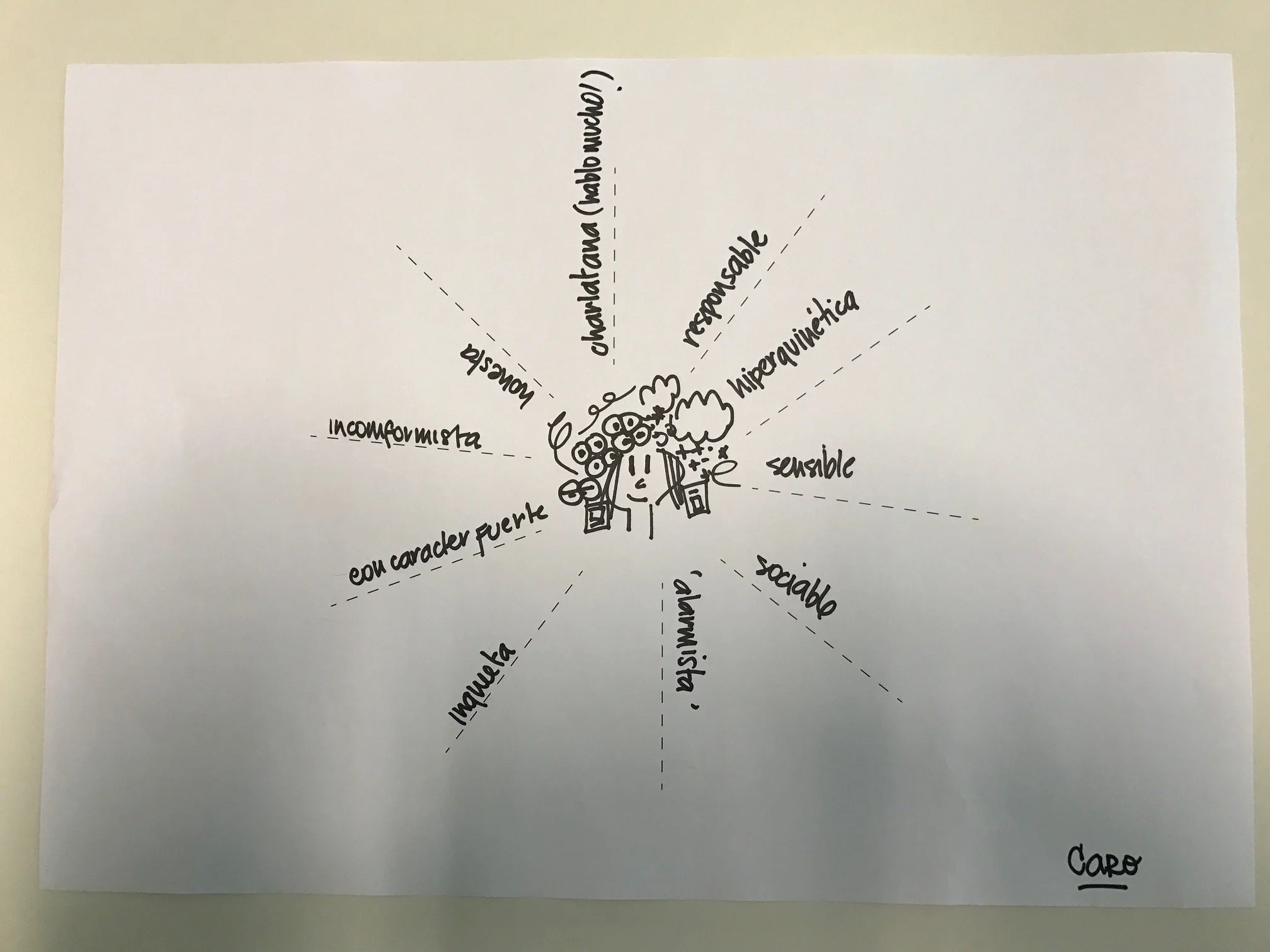

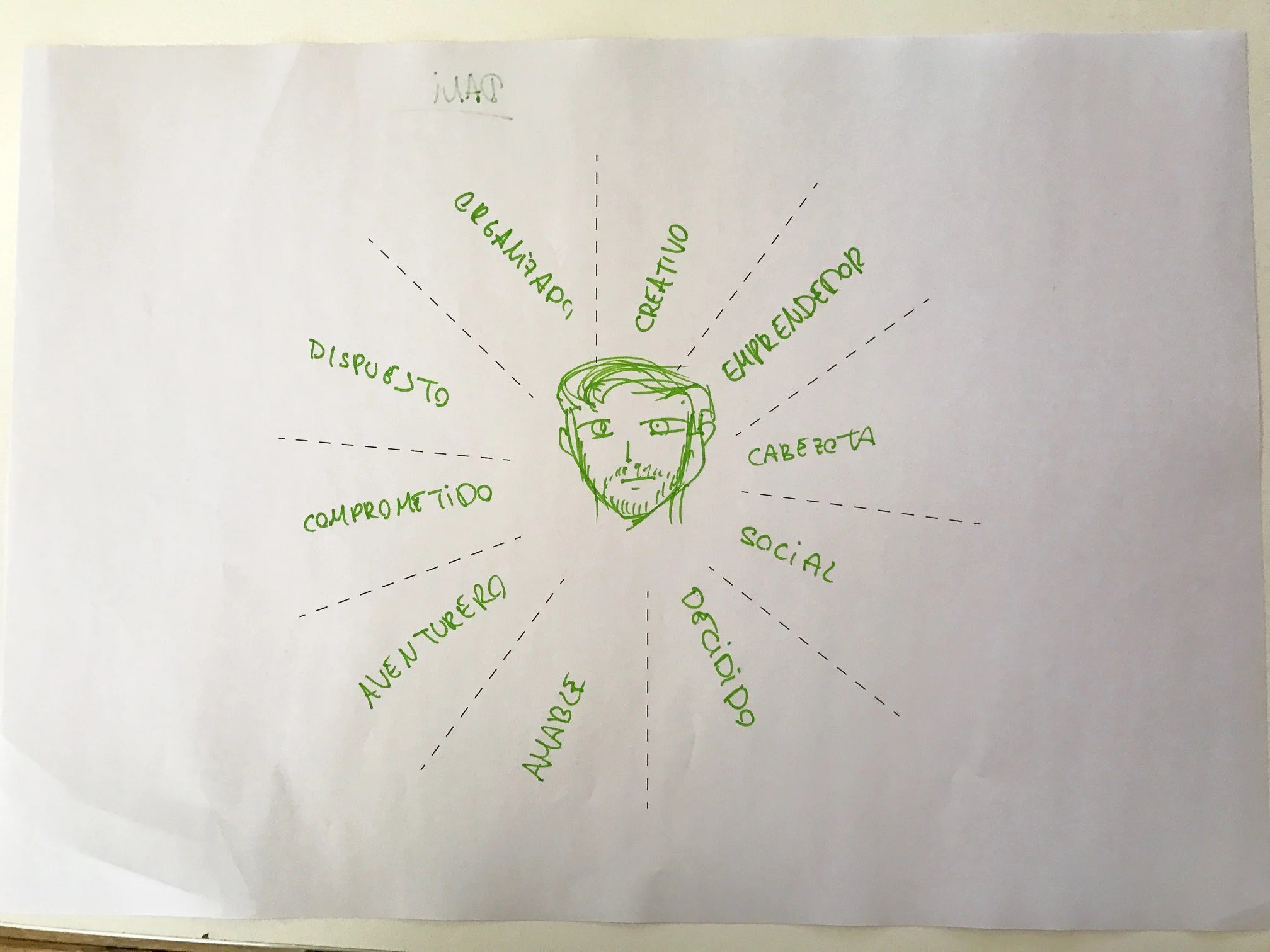

Persona development to capture key behaviours, motivations, and confidence levels

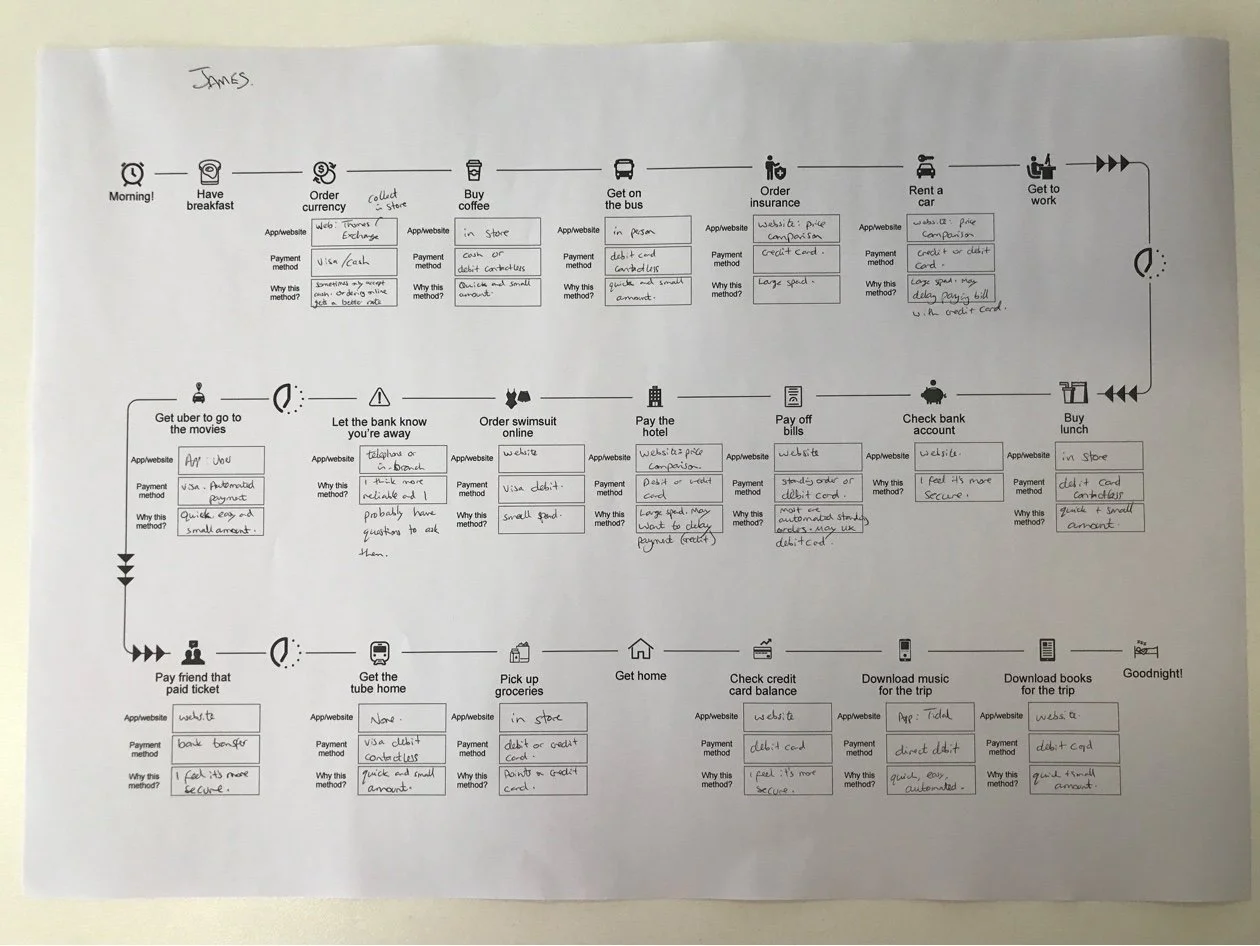

Journey mapping to identify friction points and emotional drop-off moments

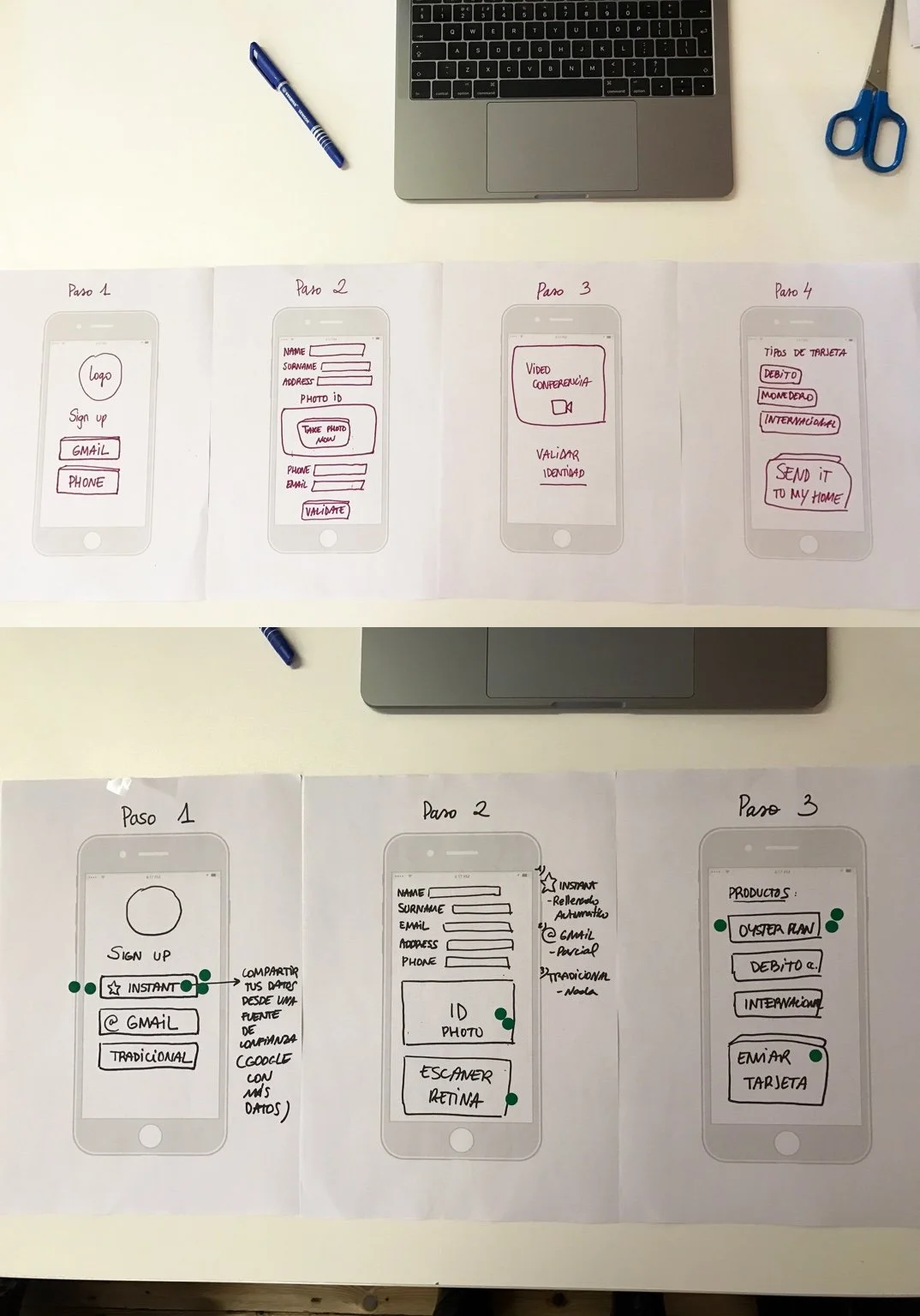

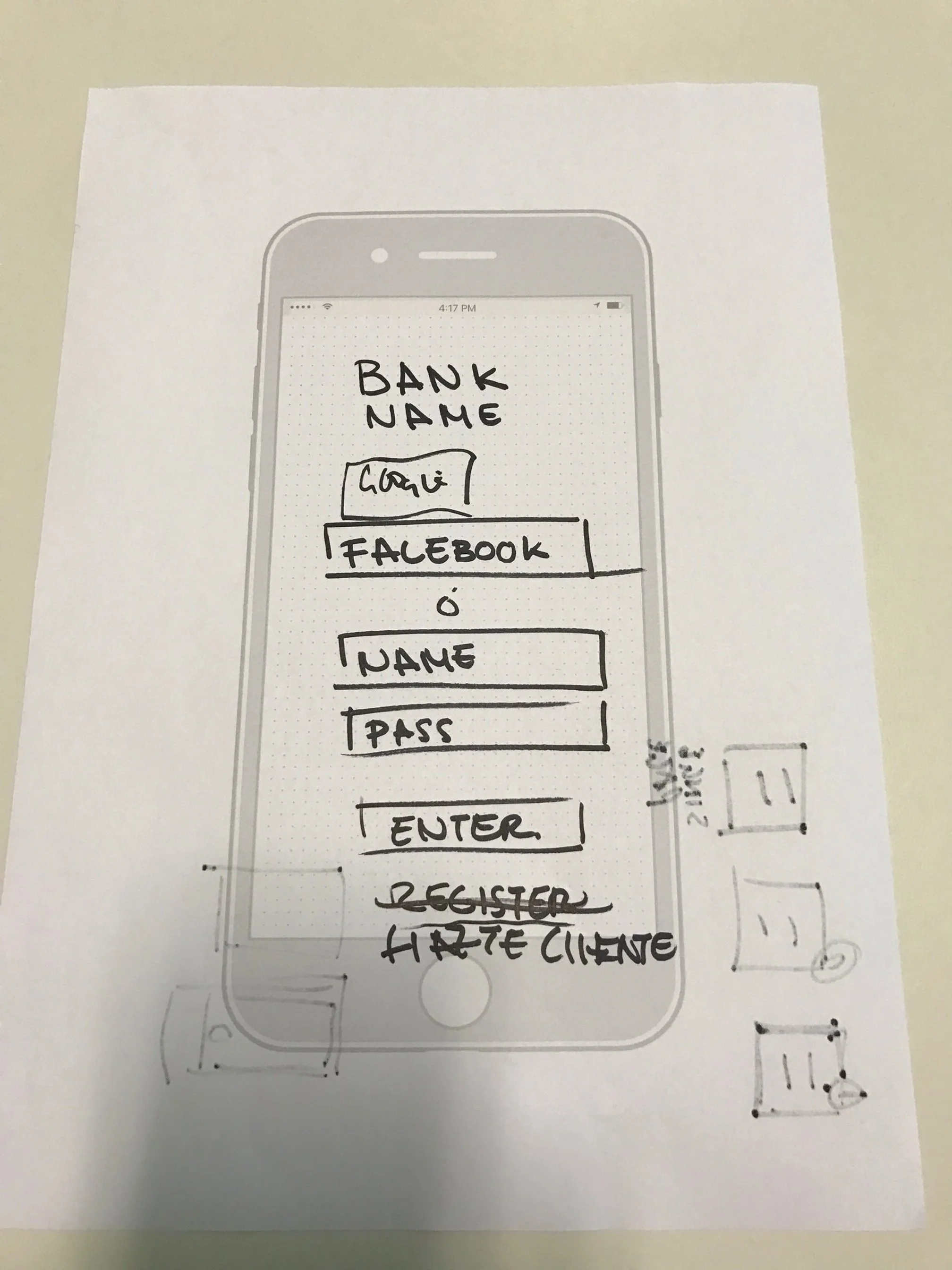

Iterative wireframing to translate insights into flows and interface concepts

This approach helped us move beyond assumptions and build a future-facing onboarding direction that reflected real user mental models.

What we learned

Across interviews and workshops, a few themes consistently came through:

Users want speed, but not at the expense of confidence

People were happy to move quickly, but only when the process felt structured, predictable, and clearly explained.Trust is built through clarity and transparency

Users needed to understand what was happening, why information was being requested, and what would happen next.Uncertainty creates friction more than effort does

The moments that slowed people down were not always the longest steps, but the ones where they felt unsure or lacked context.A guided experience reduces anxiety

Users responded positively to onboarding experiences that felt supportive and conversational, rather than form-heavy and transactional.Users wanted “social-level” simplicity and plain language

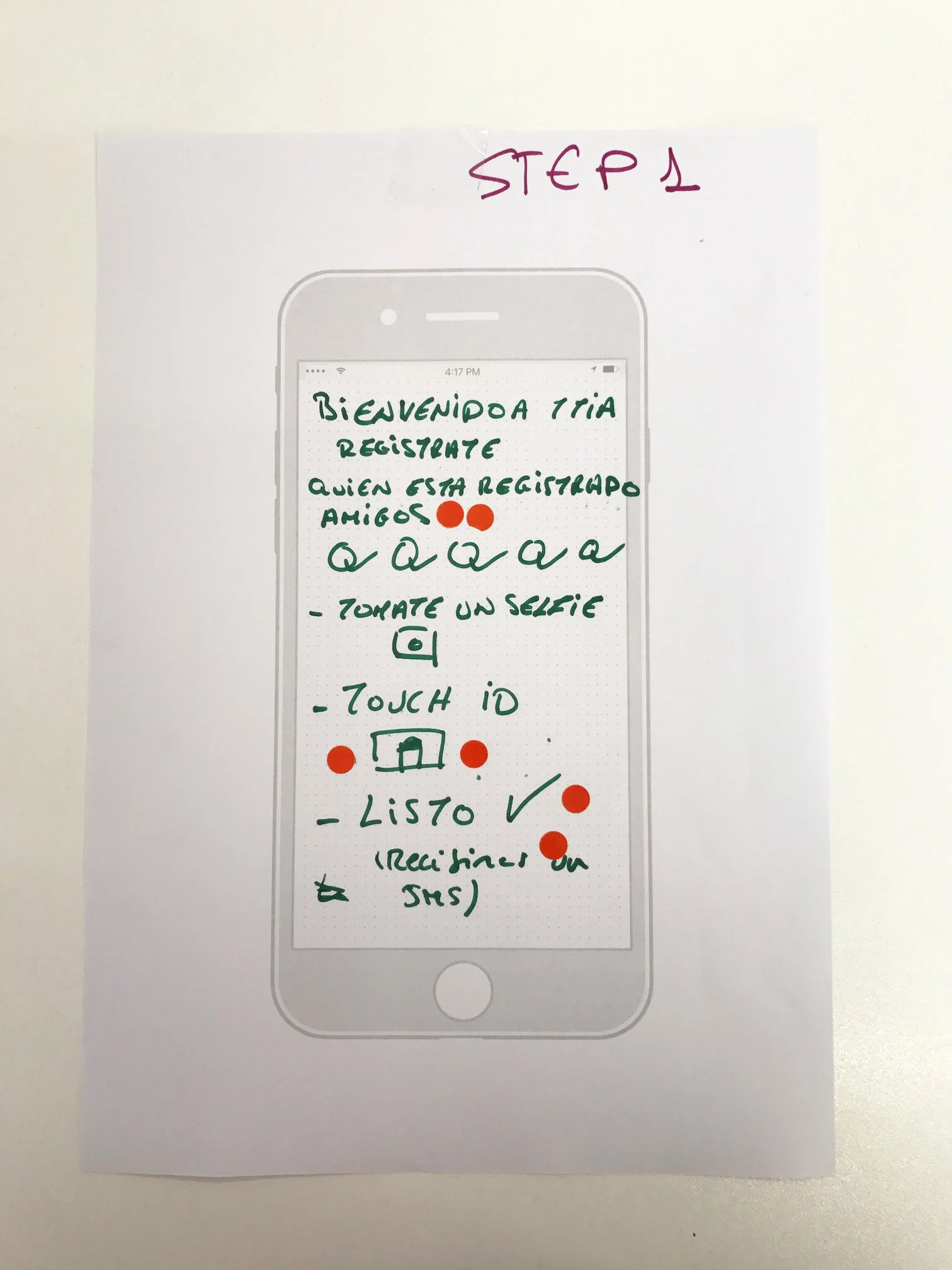

One of the strongest themes we heard was that users wanted to open a bank account as easily as they could sign up for a social platform like LinkedIn. They also wanted simple language that did not assume banking knowledge, because many terms felt too formal or unclear. A recurring expectation was having optional guidance through the process, such as a chat that could support them end-to-end when needed and help them understand each step with confidence.

Concept

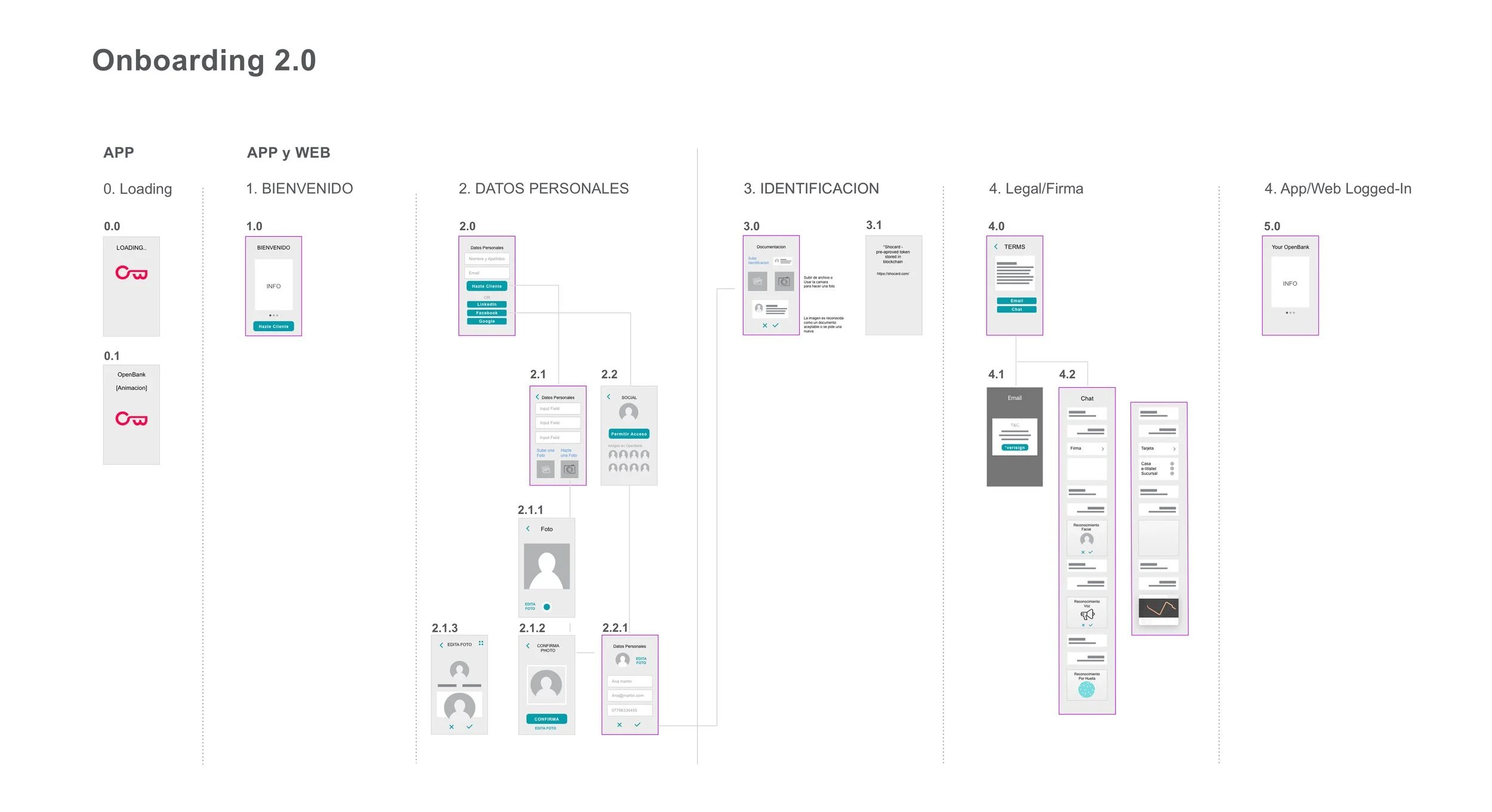

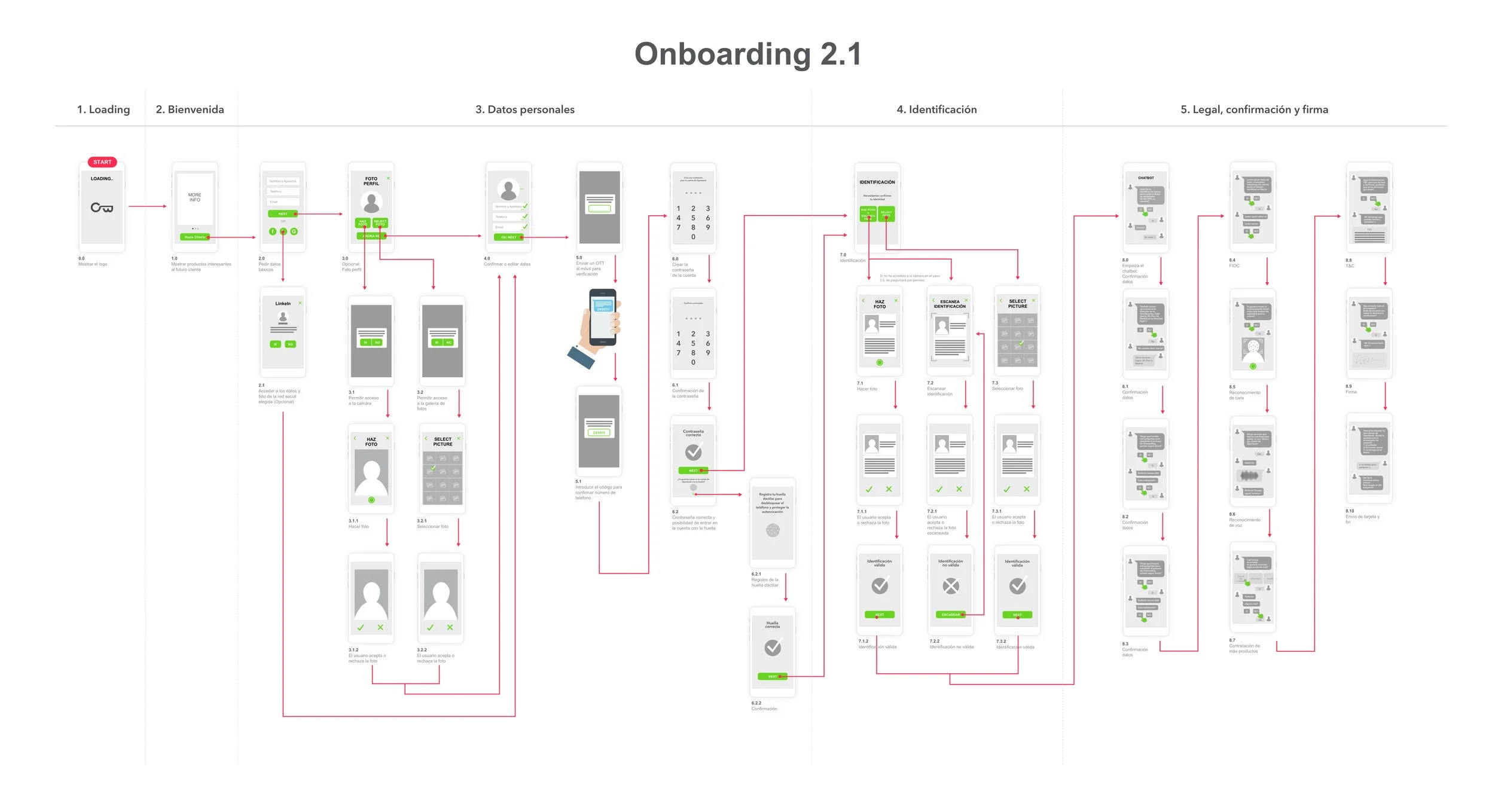

I translated research insights into end-to-end onboarding journeys, mapping key steps, edge cases, emotional states, and decision points across the service.

A core principle behind the concept was designing onboarding to feel as easy and familiar as signing up for a social platform, while still meeting strict banking and compliance requirements.

Users wanted simplicity, minimal data entry, and reassurance throughout the process. Rather than treating onboarding as a one-off form flow, we explored how it could feel like a guided service, with continuous support available whenever users felt uncertain or needed help.

We explored multiple iterations, refining the experience to:

Reduce friction and hesitation

Improve clarity and reassurance at key moments

Make onboarding feel more modern, human, and supportive

Keep compliance and identity requirements intact

This stage included low-fidelity sketches, wireframes, and flow mapping before progressing into a more defined concept.

Final concept

The final concept introduced a more guided onboarding experience designed to help users feel supported through a traditionally complex process.

Key elements of the concept included:

A clearer step-by-step structure

More reassurance and context at key decision moments

A smoother identity and verification experience

A tone that felt closer to a conversation than a form

This work gave Openbank a clear future-facing direction and a strong foundation for further product design and testing.

Outcome

This project delivered a validated onboarding vision that Openbank could use as a reference point for future product development.

It helped align internal teams around:

Where friction and uncertainty typically appear

What “reassuring and clear” onboarding looks like in practice

How to balance compliance with a more human experience

Reflection

This project reinforced how powerful discovery and co-design can be when designing complex journeys.

Instead of jumping straight into interface solutions, we built confidence through real user input, testing assumptions early, and shaping a future vision that felt both ambitious and grounded in reality.

It was also a strong reminder that in onboarding, reducing friction is not only about removing steps. Often, it is about reducing uncertainty.